Buyer Confidence Rises 2025

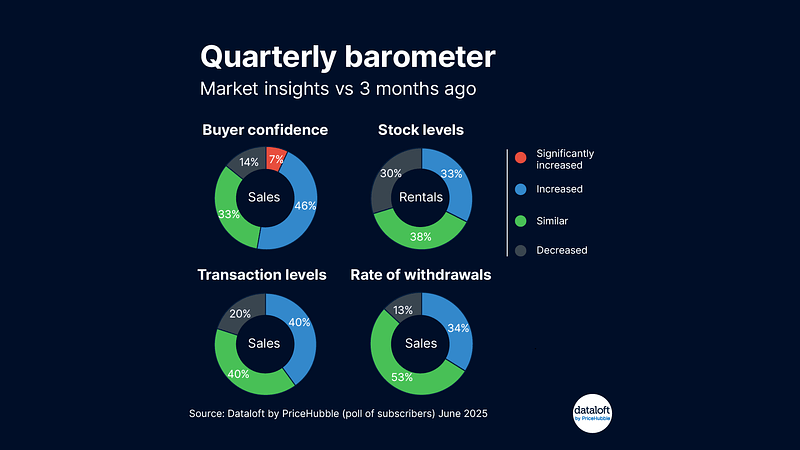

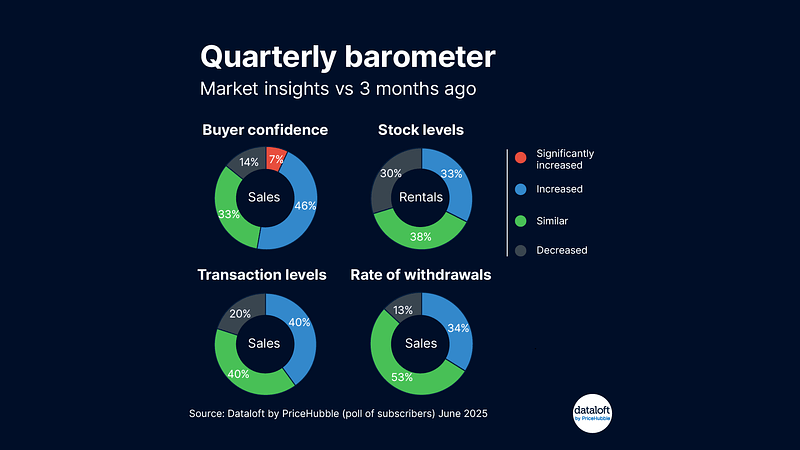

Falling mortgage rates have helped boost buyer confidence. Just over one out of two agents said conditions have improved since the last quarter. Buyer sentiment

Falling mortgage rates have helped boost buyer confidence. Just over one out of two agents said conditions have improved since the last quarter. Buyer sentiment

Thinking of selling your home? Here’s a quick look at how the market is moving. In April, the average time it took to sell a

The Sunday Times’ Best Place to Live in the UK 2025 emphasizes that quality of life extends beyond conventional metrics such as school performance or

The appeal of newly constructed homes continues to rise among prospective home movers, as evidenced by data from the Home Moving Trends Survey 2024. In

Over the past five years, average gross rental yields across England and Wales have consistently increased, reaching a peak of 7.2% in February 2025, compared

In a world of constant innovation, long-established domestic arrangements are fading, and modernist living is taking a step forward. The latest idea of “co-living” has

The Spring Statement of 2025 presented a mixed economic outlook, with a significant downgrade in the UK’s growth forecast for 2025, halving to just 1%.

March traditionally marks a peak period for property sellers, and in 2025, the market has seen a significant increase in supply, reaching the highest level

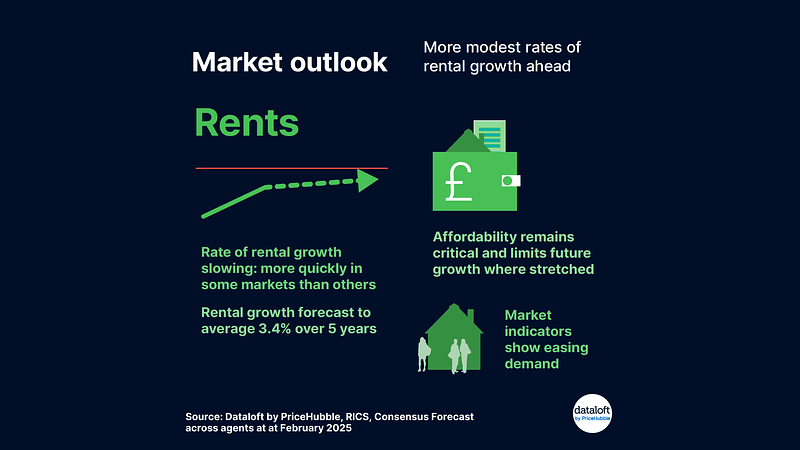

After years of high rental growth, the pace of increases in achieved rents for new market lets is slowing, with some markets experiencing this deceleration

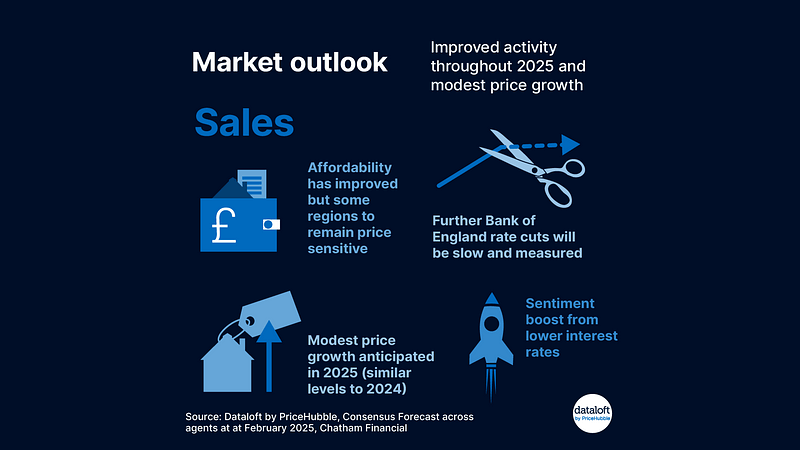

The market entered 2025 on solid foundations, with activity levels expected to strengthen over the year. Forecasts indicate that property prices will grow at a

Registered Company Number 11343947