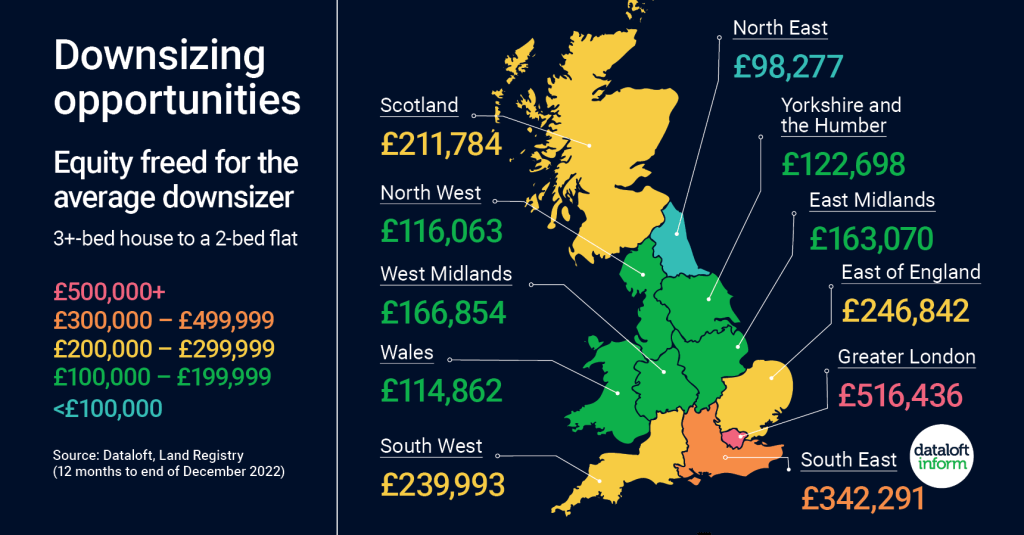

For many homeowners, downsizing from a large home to a smaller abode can be an excellent opportunity for those looking to save money. By capitalising on their home equity – the difference in prices between selling a larger property and purchasing a flat or smaller abode – substantial savings can be made. According to data the average price difference between a 3+ bed house and a 2-bed flat is £161,728 with some regions having an even greater release of over half a million pounds! Whether it’s for financial gain or lifestyle reasons, downsizing to a smaller home can provide numerous benefits.

The Monetary Benefits of Downsizing

The release of equity through downsizing is particularly dramatic in London where the average equity released by this method is an impressive £516,436. This figure rises significantly for other regions too; the South East has an average release of £342,291 while all other UK regions have at least £100,000 equity released via downsizing (with just one exception). These figures demonstrate how shrewdly trading up or down can yield significant monetary benefits; not just in terms of providing more financial freedom but also offering unparalleled convenience in terms of space and location.

Other Benefits of Downsizing

Aside from the monetary benefits of downsizing there are numerous non-financial advantages to relocating to a smaller home that should not be overlooked. With less space comes less responsibility; fewer rooms to clean and maintain as well as reduced bills due to lower energy costs. Additionally, you may find yourself with extra time on your hands now that you don’t have such large amounts of cleaning or gardening work that need doing – allowing you to focus on other activities such as spending time with family or friends, taking up new hobbies or even travelling more frequently. Furthermore, depending on where you choose to move there may be additional advantages such as being closer to amenities like shops and leisure facilities or being able to access better transport links than previously available.

When considering whether downsizing is right for you it’s important to weigh up both the financial and non-financial implications carefully before making any decisions – however there’s no denying that when done correctly it can be an incredibly beneficial process. From releasing substantial amounts of equity from your current property (particularly in London & South East regions) to gaining extra time by reducing workloads around cleaning; upkeep; there are multiple advantages associated with trading down for those looking for convenience as well as financial freedom. In conclusion, if done correctly downsizing could prove very beneficial – so why not explore your options today?