Mitcham Area Guide (Updated 2023)

The charming town of Mitcham is located on the eastern side of the London Borough of Merton. It sits close to several other noteworthy areas

The charming town of Mitcham is located on the eastern side of the London Borough of Merton. It sits close to several other noteworthy areas

Thornton Heath is a vibrant, multicultural community nestled in the London Borough of Croydon. Explore its diverse range of restaurants and bars in this pocket

Croydon is located on the edge of London, making it a great place to stay if you’re looking for easy access to the city Centre

Wallington is a suburban town in south London between Croydon and Sutton. It offers affordable family houses and three grammar schools. Wallington can be traced

Monopoly The game which has brought together and torn apart families and friends for years. A game that taught many of us how to invest,

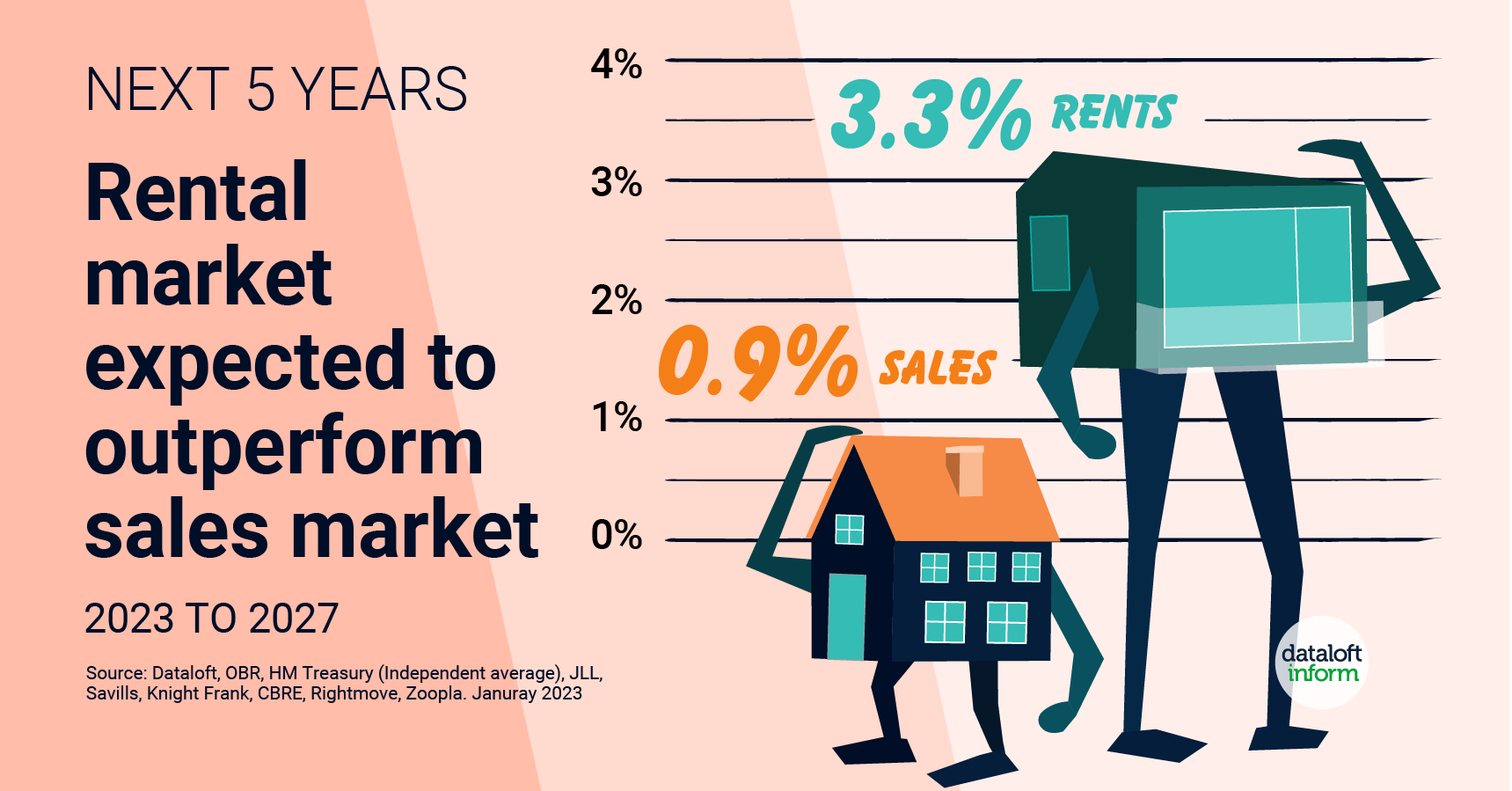

House prices have gone through the roof in recent years, but they are now falling amid soaring inflation and rising interest rates. Whilst landlords are raising

Sanderstead is a quaint village at the southern tip of Croydon in south London, with fascinating ties to English history and name origins – especially

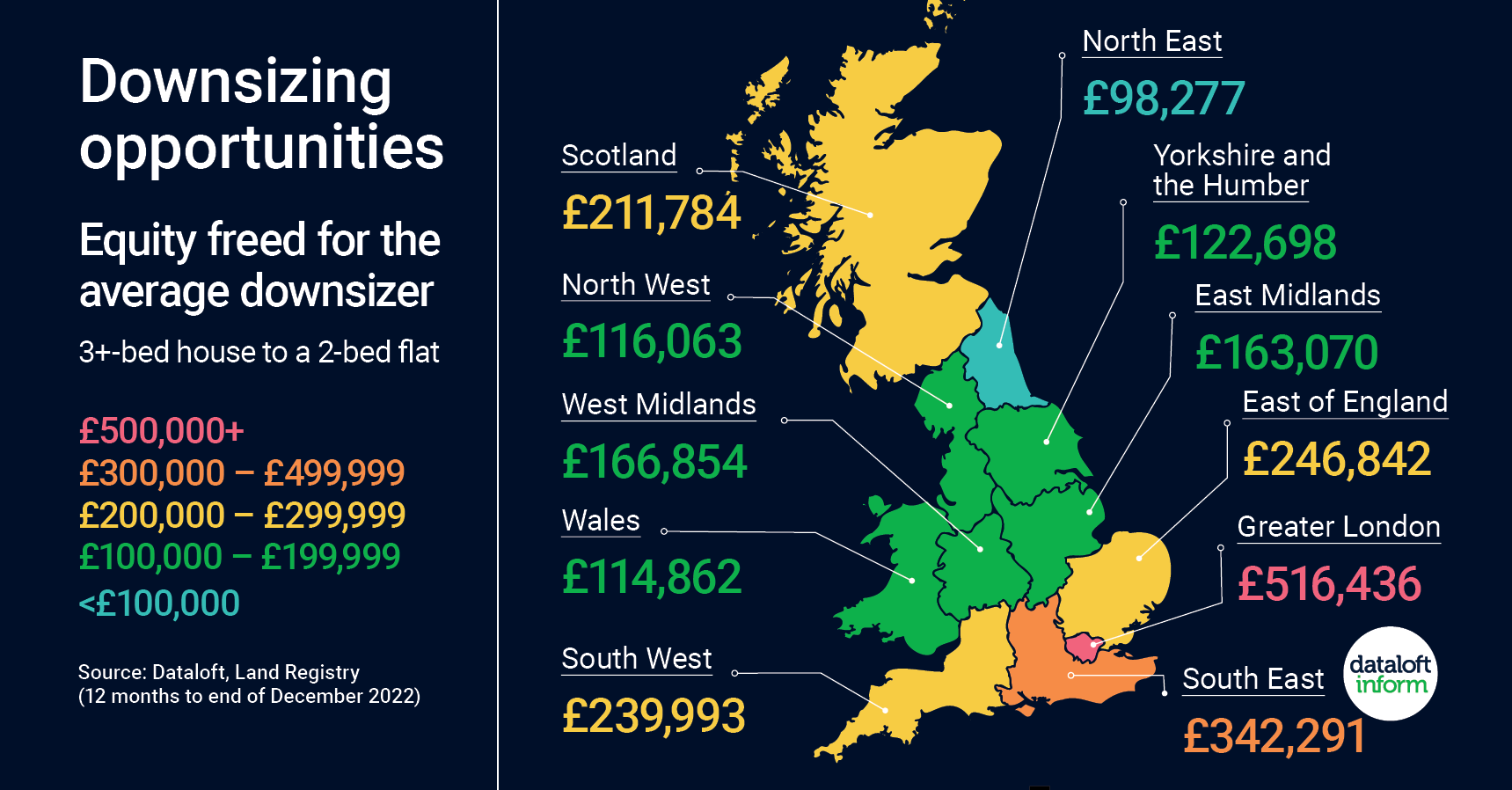

For many homeowners, downsizing from a large home to a smaller abode can be an excellent opportunity for those looking to save money. By capitalising

Pets have always been the go-to companions for many people in the UK. They can help to combat loneliness and, in some cases, help with

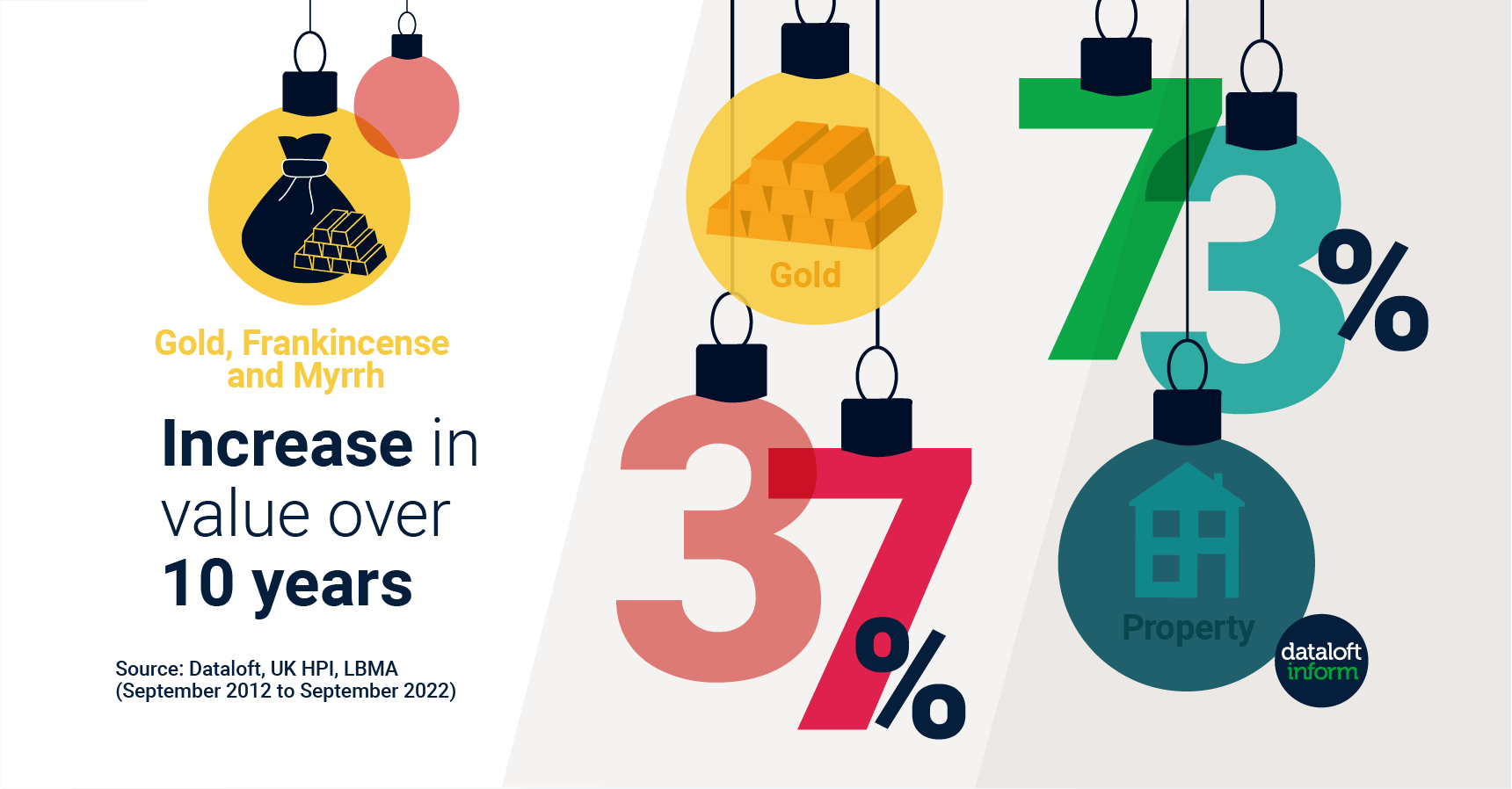

The story of the Three Wise Men gifting gold to the baby Jesus has been told for centuries, but what if one of them had

Registered Company Number 11343947