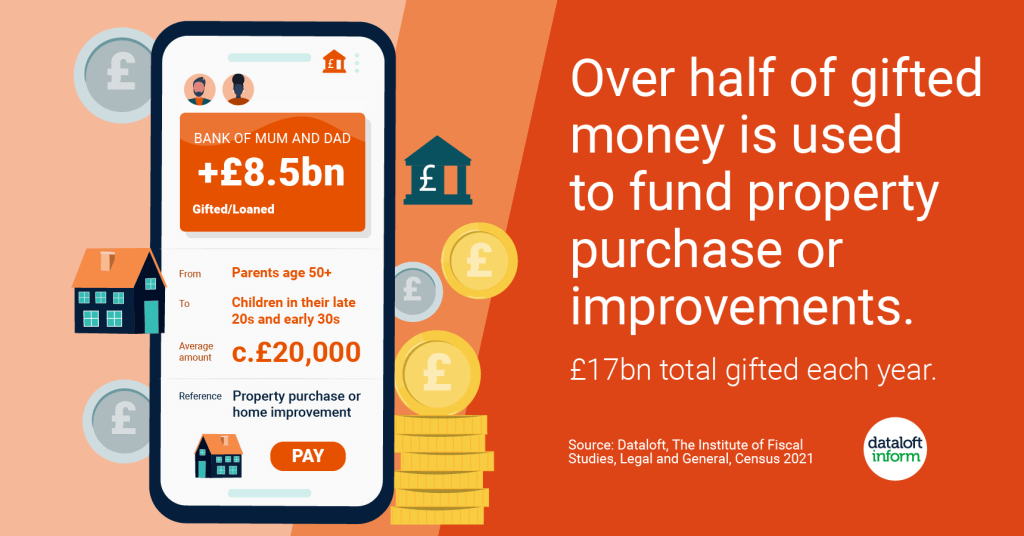

- £17 billion is gifted, or informally loaned each year, of which over half is used for property purchase or improvement (The Institute of Fiscal Studies).

- Virtually all money transfers come from parents aged over 50 to children in their late 20s and early 30s. The average gift for property purchase or improvement is over £20,000.

- The age children leave home is generally between 25 and 27 years, and the average age to purchase a first property is 33. Over 22.4% of families in the UK include one or more adult children.

- Research by Legal and General indicates that without the financial help of family and friends, over 70% of prospective home buyers would have to delay their property purchase plans, by an average of 4 years. Source: Dataloft, The Institute of Fiscal Studies, Legal and General, Census 2021

Starting my Estate Agency career at just 21, I was constantly amazed by parents who gifted large sums of money to help their children purchase a home. Who wouldn’t want to help their kids? Working in prestigious areas of South West London, I was surprised to find that the average gifted amount was only £20,000. I thought it would be a little higher.

For those without the luxury of parental financial assistance, there’s a glimmer of hope. The return of 100% mortgage is a game-changer and offers renters a chance to step onto the property ladder. I urge all renters to speak with a mortgage advisor and explore their options.

For the duration that 100% mortgages remain available I’m curious to see whether gifted deposits, 100% mortgages, or self-funded deposits will come out on top in terms of transaction splits. I think the bank of Mum and Dad may still dominate. Only time will tell!

Ryan Morgan – Truuli Property Expert