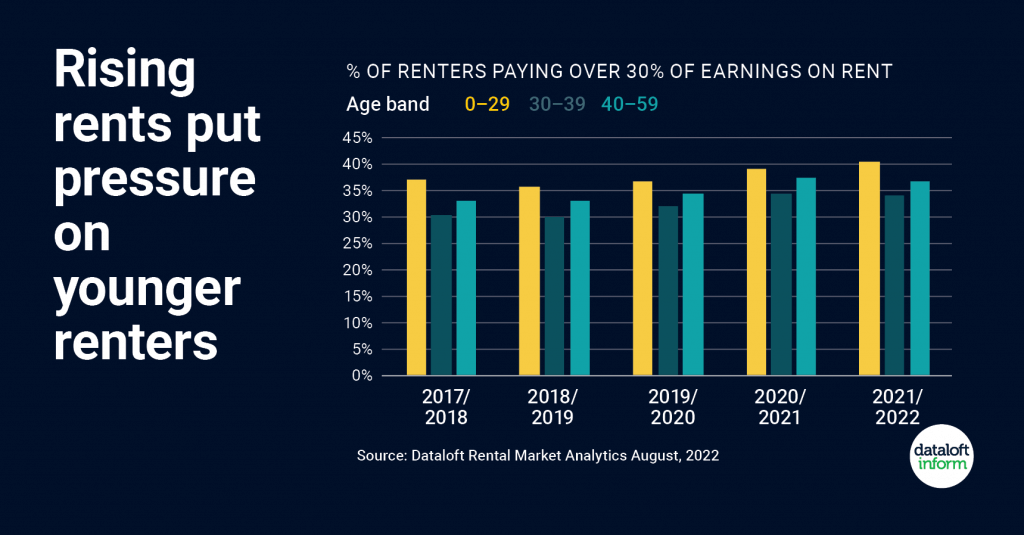

- With the rising cost of living dominating the headlines, we have turned our attention to the rental market and the affordability pressures facing renters. Using gross incomes of renters and achieved rents we can see how much renters are really spending on rent.

- As featured in a recent BBC report, 4 in 10 young renters (aged under 30) are now spending at least 30% of their income on rent, the widely accepted affordability threshold.

- While all living costs are under intense scrutiny at the moment, most renters will be prevented from overstretching on their rent commitment, by the stringent tenant referencing process.

- To pass the affordability test for tenant referencing on a new lease, the rent should represent no more than 30% of a renter’s gross income. This affordability analysis is based on data from around 40% of all new rentals. Source: Dataloft Rental Market Analytics

The rising cost of living has not stopped prospective tenants from making offers over the asking price on properties. As well as inflated offers, I am still witnessing multiple offers on properties. I believe this is due to the ongoing lack of rental properties being offered to the market in good condition. This has led to tenants being almost desperate not to lose an opportunity once they have sought out a property of interest.

With all that is going on with monthly household bills on the rise, I would have anticipated tenants making lower offers or for the market to have slowed down. However, at present, this has not deterred tenants from securing their ideal rental property at a higher price. With this said, I do believe the current affordability test for tenant referencing needs to be reviewed as the majority of tenants still find it hard to meet the necessary requirements.

Leigh Thomas – Truuli Property Expert