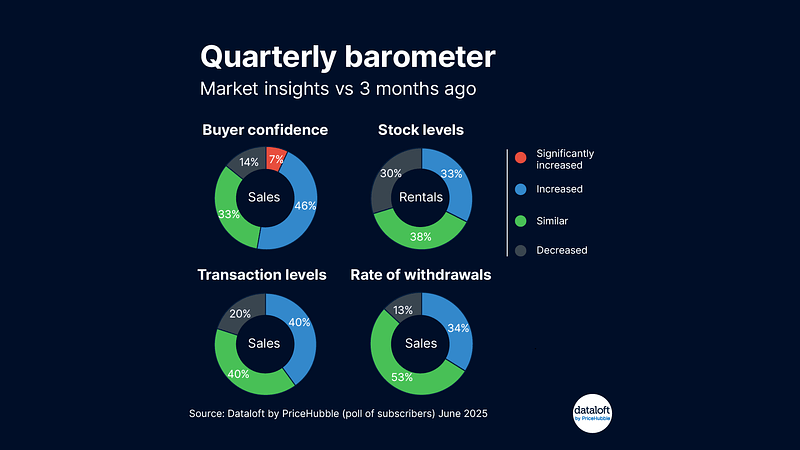

Falling mortgage rates have helped boost buyer confidence. Just over one out of two agents said conditions have improved since the last quarter. Buyer sentiment is picking up too — 46% noticed more confidence, one out of three said levels were unchanged while only 7% saw a significant jump. This shows a steady upward trend without major shifts.

Following the stamp duty lull, transaction volumes bounced back strongly between April and May, rising by 25%. Still, only 40% of agents felt transaction levels matched the previous quarter. Meanwhile, 20% reported a decline, pointing to a recovery that’s still uneven.

Sales withdrawals remain stable. Around one out of two agents said the rate hasn’t changed while 34% noticed a decrease and 13% saw an increase. This suggests most sellers are staying the course.

In the rental sector, demand is steady but supply is tight. 38% of agents reported a drop in available rental properties, one out of three said levels have stayed the same while 30% saw an increase. This reflects growing pressure on rental stock.

Overall, the data suggests a market regaining momentum, led by improving buyer confidence and rising transactions though supply challenges and regional differences remain.