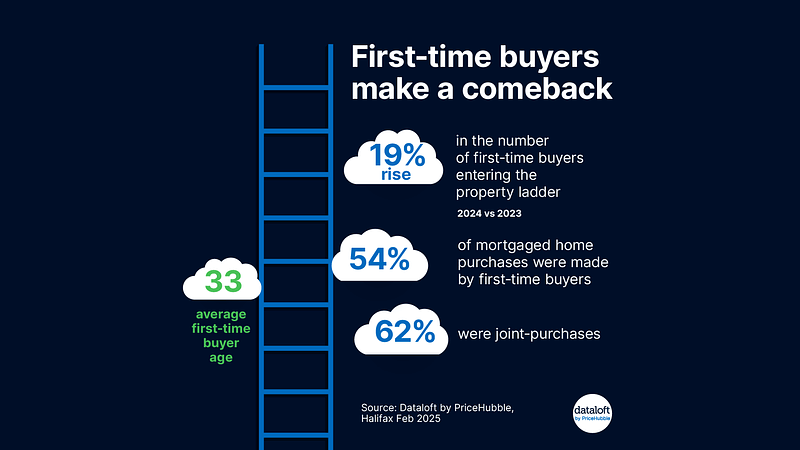

The number of first-time buyers entering the property market increased by 19% in 2024 compared to 2023, reaching 341,068. Although this remains below the 2022 peak of 369,870, it marks a significant recovery following the decline in 2023. This resurgence is likely linked to improved mortgage affordability, as interest rates have stabilised, offering greater financial certainty to prospective buyers.

First-time buyers accounted for 54% of all mortgaged home purchases, demonstrating their substantial presence in the market. Additionally, 62% of these transactions involved joint purchases, indicating a trend toward shared homeownership. The average age of a first-time buyer is 33, reflecting the demographic profile of those stepping onto the property ladder. These trends suggest a revival in first-time home ownership, driven by more favourable financial conditions.