The market entered 2025 on solid foundations, with activity levels expected to strengthen over the year. Forecasts indicate that property prices will grow at a rate of 3.1% in 2025 and 3.7% in 2026, maintaining a trajectory similar to that of 2024.

Mortgage approval and transaction rates have stabilized after a period of weakness from late 2022 through early 2024, aided by recent interest rate cuts that have improved market sentiment. However, while lower rates have encouraged activity, long-term mortgage rates are expected to settle around 4%, with the current 5-year swap rate—the basis for mortgage pricing—standing at this level.

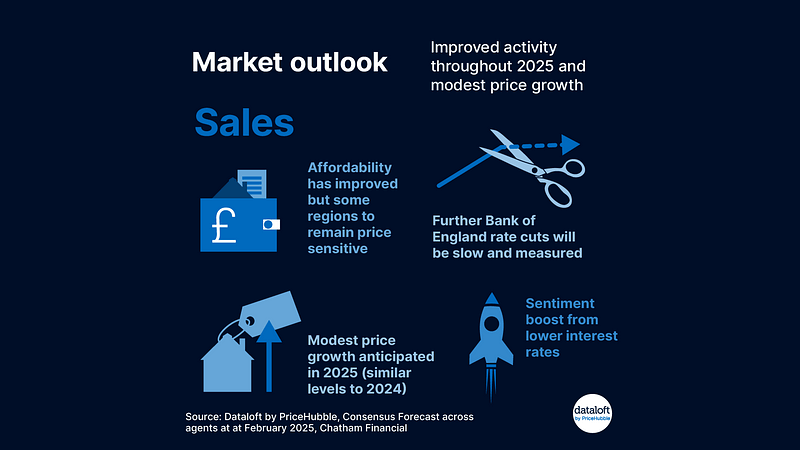

Despite these improvements, persistent inflation above target levels means that further interest rate cuts by the Bank of England will be gradual and cautious. Housing affordability has improved overall, though price sensitivity will persist in high-cost regions such as London and the South East, where affordability constraints remain more pronounced.

The pace of price growth will depend on affordability headroom across different market segments. A key opportunity for the sector, beyond increased transaction volumes, lies in the new build market as government initiatives push toward house-building targets.

In summary, market activity is predicted to improve throughout 2025, with modest price growth aligning with previous trends. Interest rate reductions have bolstered confidence, but their future trajectory will be measured due to inflationary pressures. Regional disparities in affordability will shape price growth, and new housing developments present a significant area for expansion.