- In its August meeting, the Bank of England increased its base rate to 1.75%. Its sixth consecutive rise and its highest single rise in 27 years.

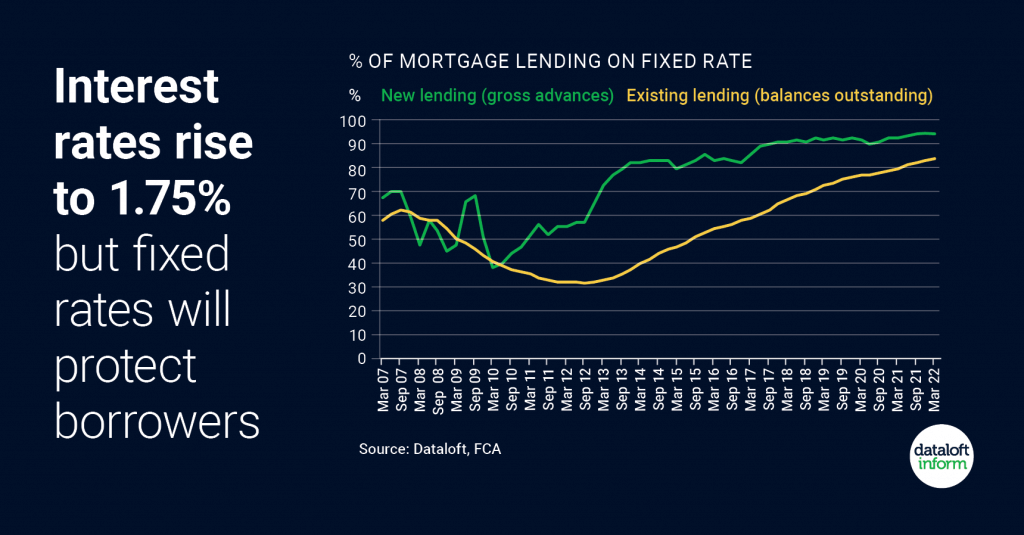

- Many borrowers are protected from any immediate payment increase by fixed mortgage rates. 94% of new mortgages in Q1 2022 (gross advances) were on fixed rates.

- And 84% of all existing outstanding mortgage lending was on a fixed rate by the end of Q1 2022.

- This is quite different from 10 years ago when only 57% of new lending and 32% of existing lending were fixed rates.

- For new borrowers, lending is getting more expensive. The average 5-year fixed rate in June was 2.9% for those with a 25% deposit and 3.5% for those with a 5% deposit according to the Bank of England. Source: Dataloft, FCA

So the inevitable has happened! It is great to see in the statistics that mortgage consumers were prepared (and probably well advised by their mortgage advisors) and are now in the best position to also get through the increased cost of living and save for their next home. It will be interesting to see how these figures differ for Q4. I anticipate we will see a higher figure than 94% of new mortgage applications being on a fixed rate.

As lending will begin to get more expensive this will affect the housing market in two regards; buyer activity and house prices. Over the last few months, we have seen the interest rates steadily increase, however, we are still registering and arranging viewings for an overwhelming amount of prospective purchasers but the costs of the mortgage combined with the rates available have been affecting the level of offer they have been putting forwards to our vendors.

Since the latest announcement, we have had more prospective purchasers revert back to us to negotiate offers on properties they have previously seen in a bid to secure a mortgage for a property, before the rates offered by the banks increase and potentially price them out of the mortgage based on their affordability.

I am excited to be heading towards September, one of my favourite months as an Estate Agent! Historically this is the busiest time for properties to come to the market along with agreeing on a large number of sales. It will therefore be interesting to see how consumers respond to the increase in rates. I am looking forward to another month of achieving the best possible price for our vendors and helping prospective purchasers start their exciting journey of home buying. I fully expect the Croydon property market will continue to be buoyant with its affordable housing element.

Ryan Morgan Truuli Property Expert