The story of the Three Wise Men gifting gold to the baby Jesus has been told for centuries, but what if one of them had given him something else? Had the Magi known about the value of property, they could have given the gift of a house and it would have grown in value much faster than gold has done over the past 10 years. Let’s explore the numbers and take a look at why property might be a better investment than gold.

The Average Price of Houses in The UK

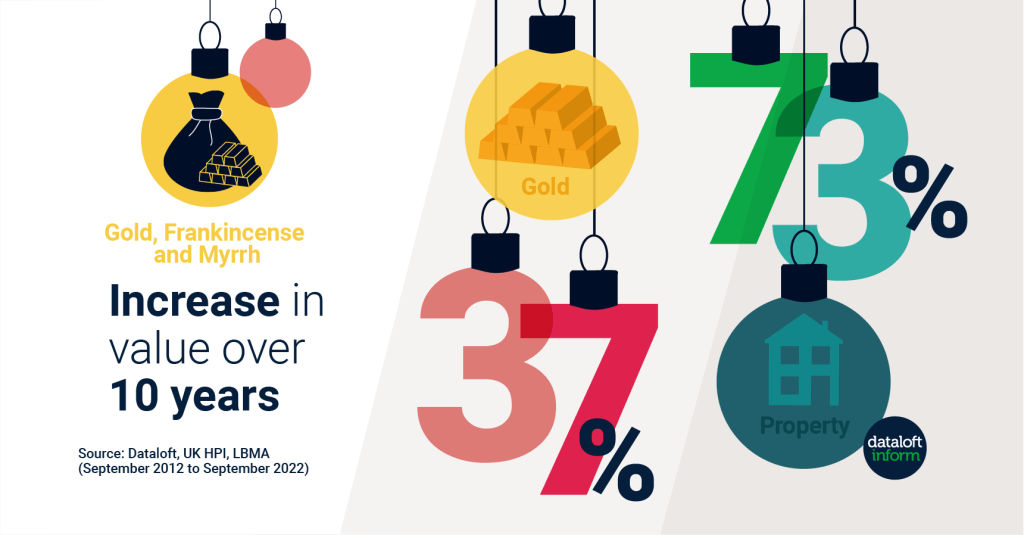

The average price of a house in the UK is currently £294,559, according to Dataloft. That’s 73% higher than it was 10 years ago when it was £170,295. In comparison, the value of gold has only risen by 37% over that same period. This means that if you had bought an average priced home in 2012 and sold it now, you would have made more money than if you had invested in gold over that same time frame.

Forecasting House Prices Over The Next 3 Years

Price growth is expected to slow down over 2023 and 2024 as there are concerns about a potential housing market correction due to economic factors such as rising inflation. However, according to the Office for Budget Responsibility (OBR), growth is expected to resume from 2025 onwards as confidence returns to the market and prices start to rise again.

It’s important to remember that while this forecast is based on current data trends, it can still change due to external events so it’s important not to make any long-term investments decisions without doing your own research first.

As we can see from these figures, property investments may offer greater financial rewards than gold investments over certain periods of time – although like all investments there are risks involved which need careful consideration before making any commitments. It’s always wise to speak with financial advisors or estate agents before deciding whether or not investing in property is right for you – they’ll be able to provide advice tailored specifically towards your circumstances which will help you make an informed decision about your finances. By taking their advice into consideration and researching both markets thoroughly, you should be able to make an investment decision with confidence.