Latest Property News From Truuli

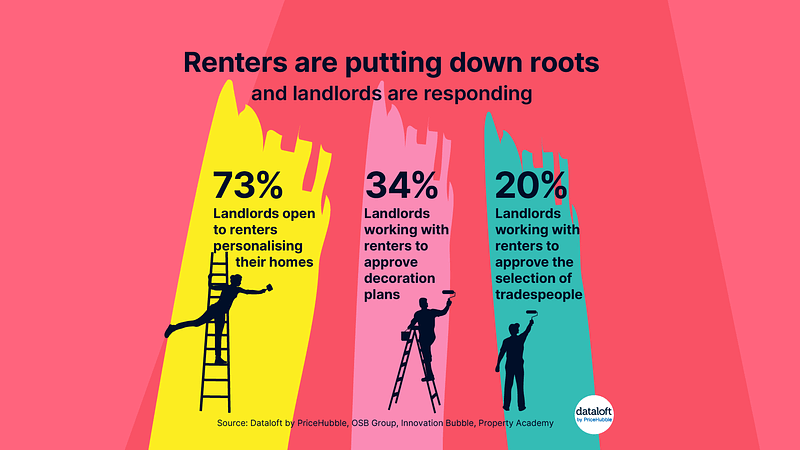

Renters are putting down roots

Renter behaviors are shifting significantly, with renting no longer seen solely as a temporary phase before homeownership but increasingly becoming a long-term lifestyle choice. As tenants establish deeper connections with their rental properties, landlords are adapting to meet these evolving expectations. A substantial 73% of landlords are open to renters personalizing their homes, reflecting a growing flexibility in property management. Additionally, 34% of landlords collaborate with renters to approve decoration

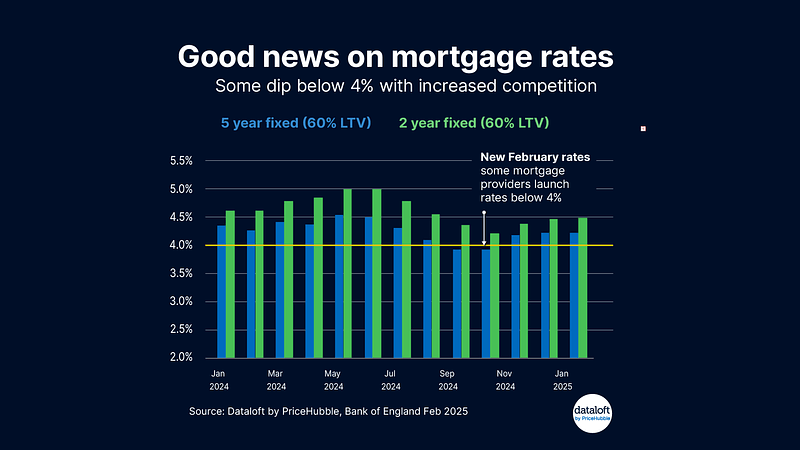

Good news on mortgage rates

The mortgage market has seen a positive development as increased competition among lenders has led to interest rates dipping below 4% for certain mortgage deals with a 60% loan-to-value (LTV) ratio. The chart illustrates the trend in fixed mortgage rates over the past year, comparing 5-year and 2-year fixed rates. While rates have fluctuated, the latest data from February 2025 indicates that some mortgage providers have introduced rates under the

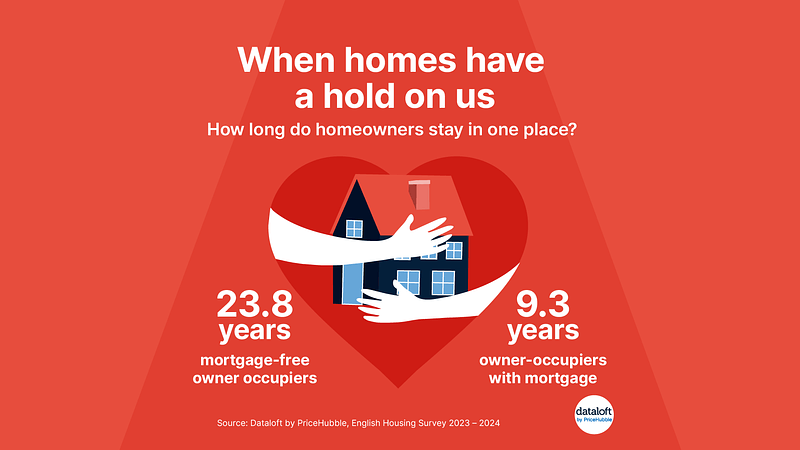

When homes have a hold on us

The process of buying a home is often compared to falling in love, as both experiences involve emotional highs and lows. According to data from the English Housing Survey 2023–2024, homeowners’ length of stay in one place varies significantly based on their mortgage status. Mortgage-free owner-occupiers remain in their homes for an average of 23.8 years, demonstrating long-term stability and attachment to their property. In contrast, owner-occupiers with a mortgage

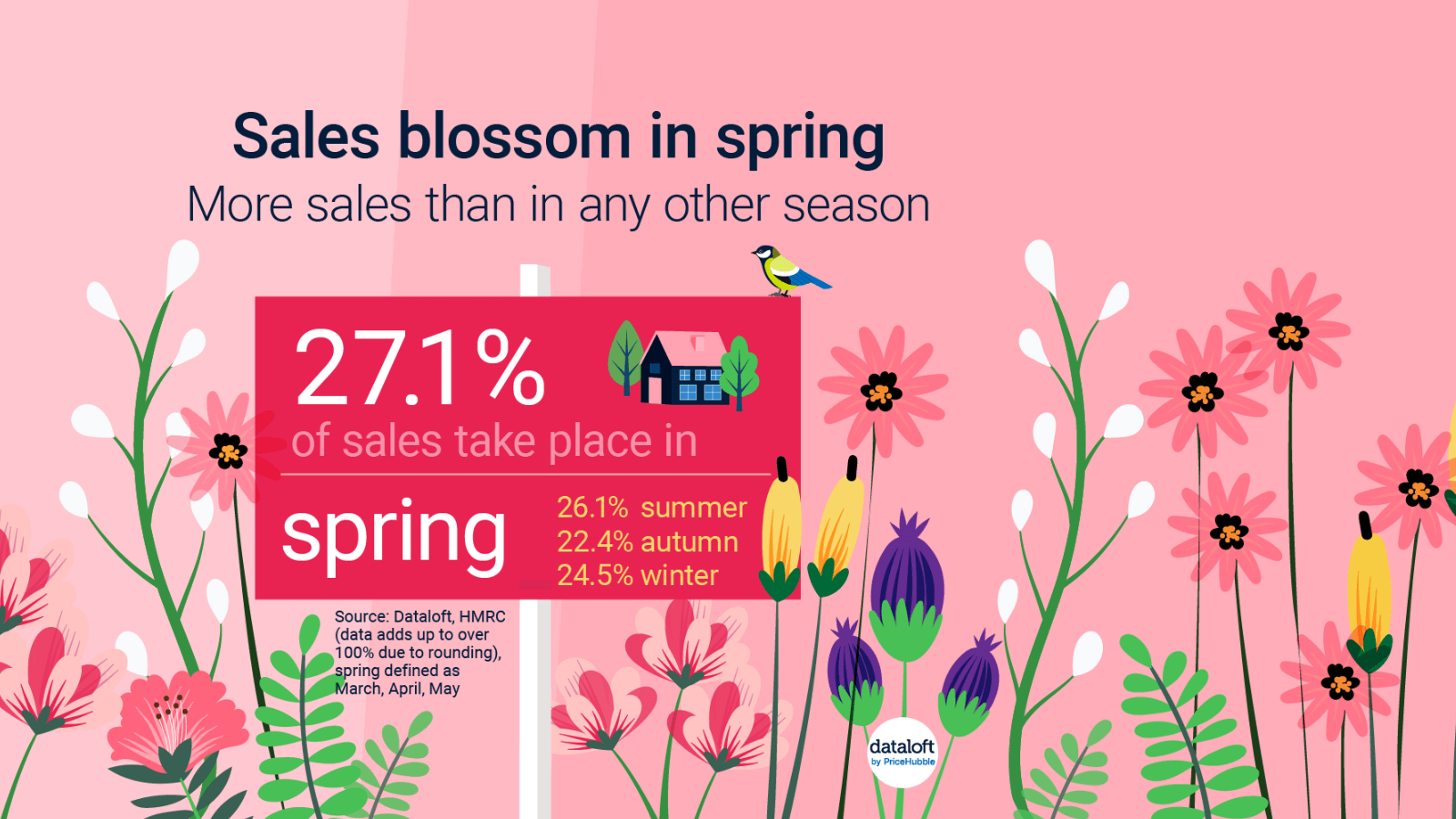

Truuli expects the market to “Spring” into action

As March arrives, longer days and brighter skies draw more home buyers out to hunt for their dream property. Spring sees a surge in home sales, with 27.1% of transactions occurring during this season – the busiest of the year. Selling benefits in spring: Preparing your home for a spring sale: Ready to sell or buy? Contact us at 0330 043 0002 Leigh Thomas – Truuli Property Expert

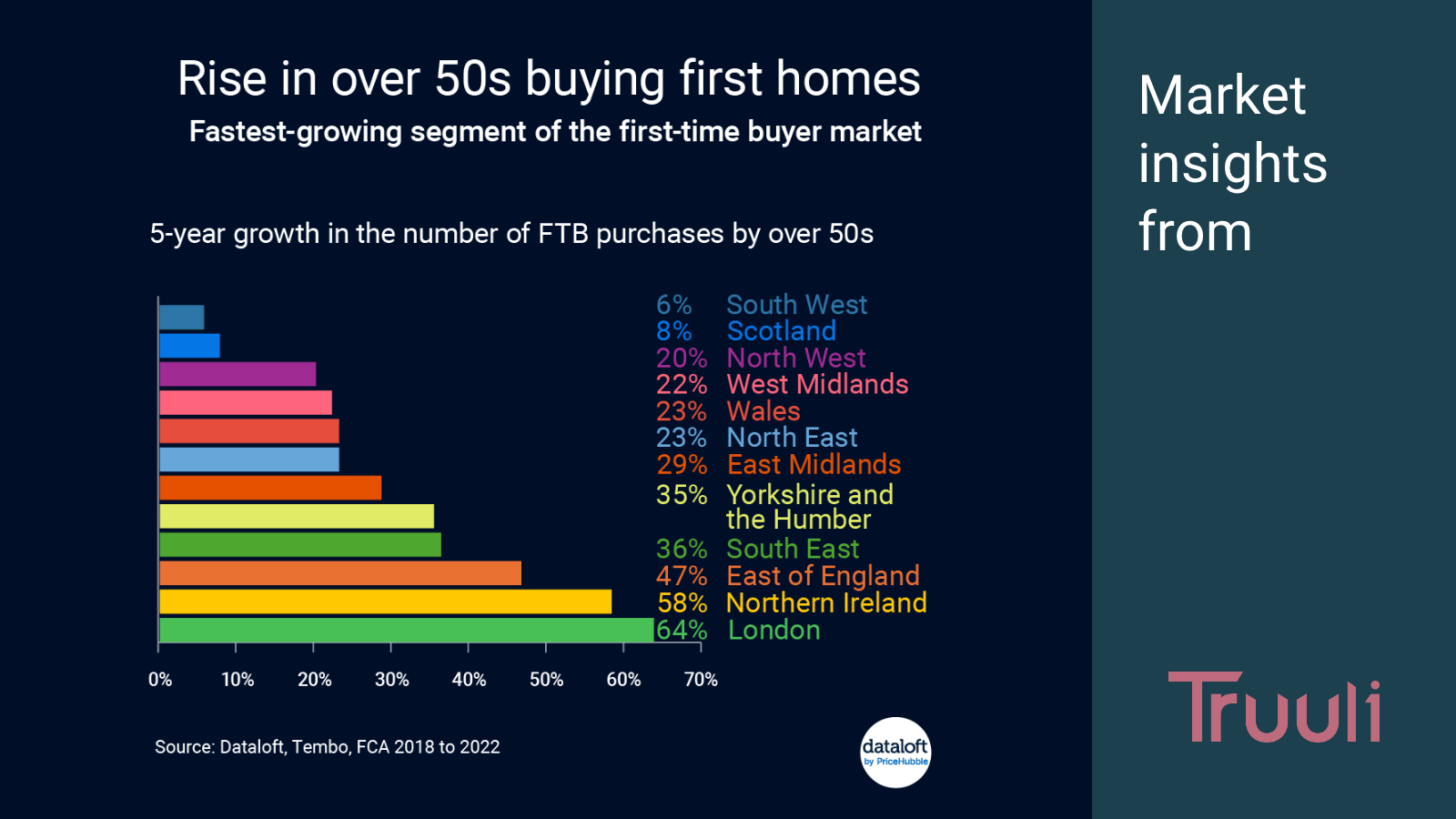

Rising Trend: Over 50s Stepping into Homeownership as First Time Buyers

The number of first-time buyers (FTBs) above the age of 50 has surged by over 30% in the last five years, while the proportion of those aged 30 and under is on the decline. With affordability becoming a challenge, more people are waiting until they are over 50 to purchase their first home. Interestingly, although London currently has the lowest percentage of first-time buyers above the age of 50, it

Seller asking prices rise by 1.3% in Jan 2024

The average asking price for new sellers had a significant increase of 1.3% in January, marking the highest price rise since 2020. This growth is more than double the average increase seen over the past 20 years (+0.6%). With mortgage rates decreasing and a positive economic outlook, buyer demand is on the rise. In fact, 42% of agents have reported higher buyer demand compared to the previous year. Furthermore, the

Categories

- Area Guides (6)

- Buying (5)

- Buying Guide (5)

- Jobs (1)

- New Homes (1)

- News (73)