Rising Trend: Over 50s Stepping into Homeownership as First Time Buyers

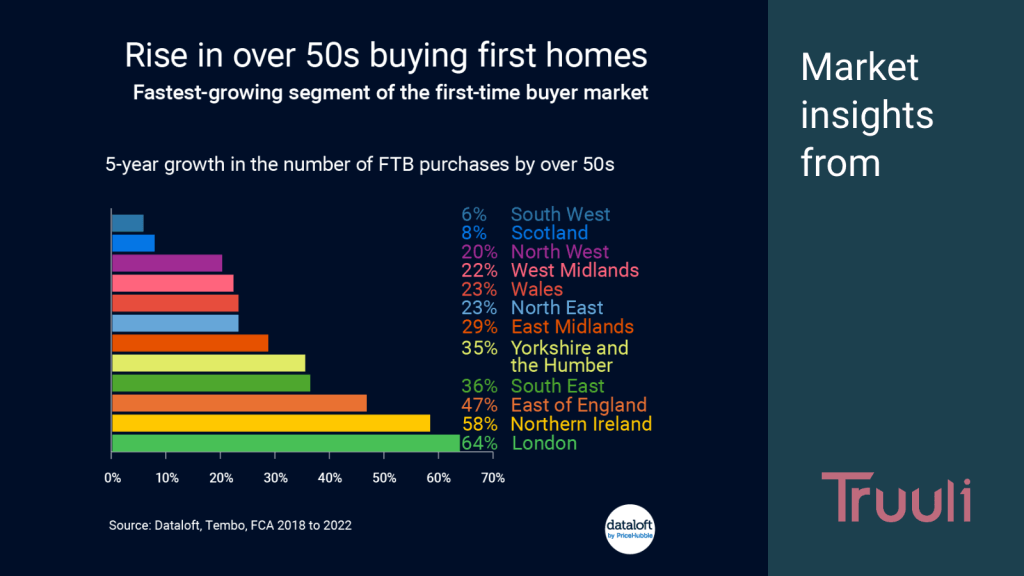

The number of first-time buyers (FTBs) above the age of 50 has surged by over 30% in the last five years, while the proportion of those aged 30 and under is on the decline. With affordability becoming a challenge, more people are waiting until they are over 50 to purchase their first home.

Interestingly, although London currently has the lowest percentage of first-time buyers above the age of 50, it is experiencing the fastest growth rate. The total purchases from over-50s have increased by an impressive 64% between 2018 and 2022.

Looking ahead, it’s projected that over-40s will make up a quarter of all first-time buyer transactions by 2030, while those in their fifties will account for 5%. These findings come from #Dataloft, Tembo, FCA data spanning from 2018 to 2022.

Rising Trend: Over 50s Stepping into Homeownership as First Time Buyers Read More »