How long are homeowners or renters staying in thier homes?

- While we wait for the 2021 census housing data we look to the newly published 2020/21 English Housing Survey data to help us understand the changing relationship we have with our homes since the last census.

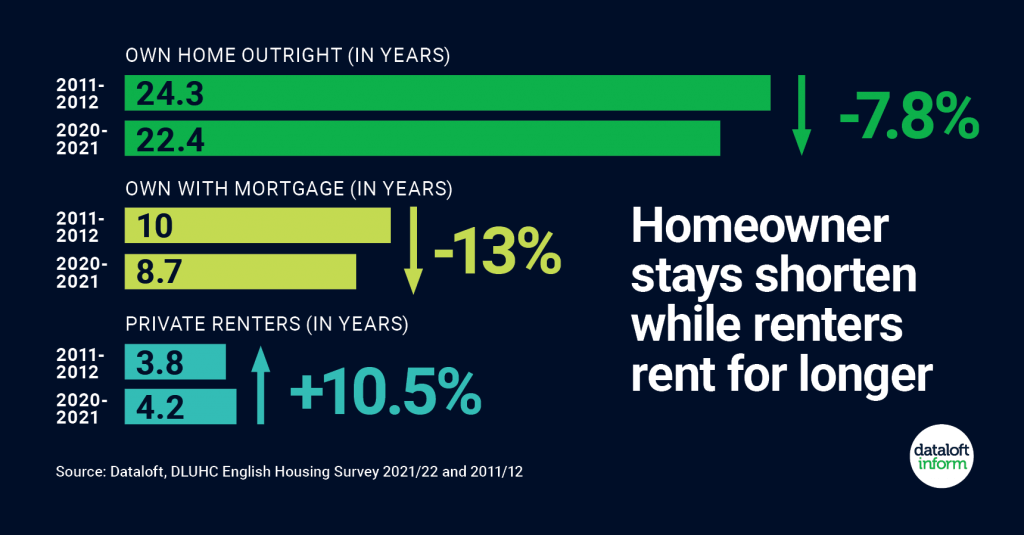

- Since 2011/12, owner occupiers have seen a drop in their length of tenure, from an average of 17.1 years in their accommodation to 16 years in the new 2020/21 survey results.

- In contrast, private renters have increased their tenure length, increasing from an average of 3.8 years in 2011/12 to 4.2 years in 2020/21.

- This slight swing to longer private tenancies comes amidst a new cost-of-living crisis where the English Housing Survey reports 52% of private renters feeling that they are unlikely to be able to afford to buy a home. In 2011/12, this figure was 41%. Source: Dataloft, DLUHC English Housing Survey 2021/22 and 2011/12

There can be several personal and/or economic reasons why people move homes such as change of employment, children’s schooling, family growth or even the cost of living crisis many currently find themselves in.

Within the Thornton heath area, mature homeowners usually stay in their homes for between 12 to 15 years. Homeowners in their thirties appear to move more often; normally within five to ten years, mainly due to a family expansion. On occasion, these homeowners move to be closer to retired parents to gain assistance with childcare.

The majority of first-time buyers are required to save up longer for a deposit to buy and in turn, are engaging in longer tenancies. This has seen a boost to the rental market where we are also noticing a lot more properties becoming available for rent.

With interest rates rising along with the cost of living it remains to be seen whether this creates new trends for the number of years homeowners occupy their homes, and also whether these factors continue to contribute to the rental sector.

If you are considering moving home either buying, selling or letting, please give us a call on 0330 043 0002 and speak with one of our Property Experts who will be happy to assist with all your property-related queries.

Leigh Thomas

Truuli Property Expert

How long are homeowners or renters staying in thier homes? Read More »