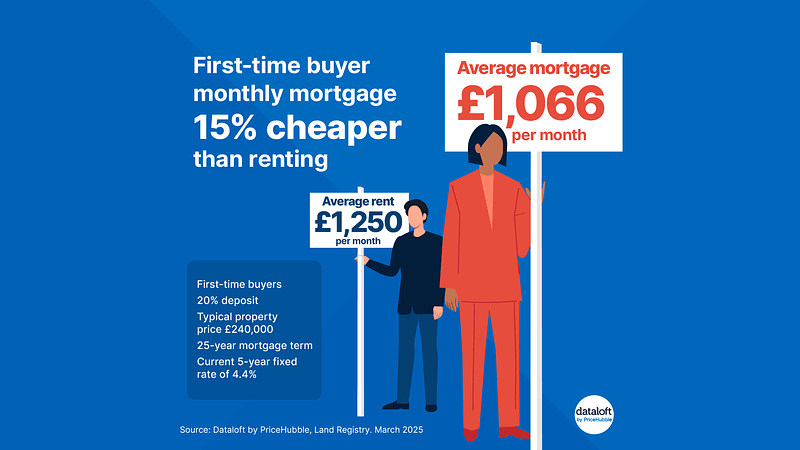

First-time buyer monthly mortgage now 15% cheaper than renting

A significant shift in housing affordability has emerged as rising rental prices have made homeownership, on average, 15% cheaper than renting, reversing a prior trend.

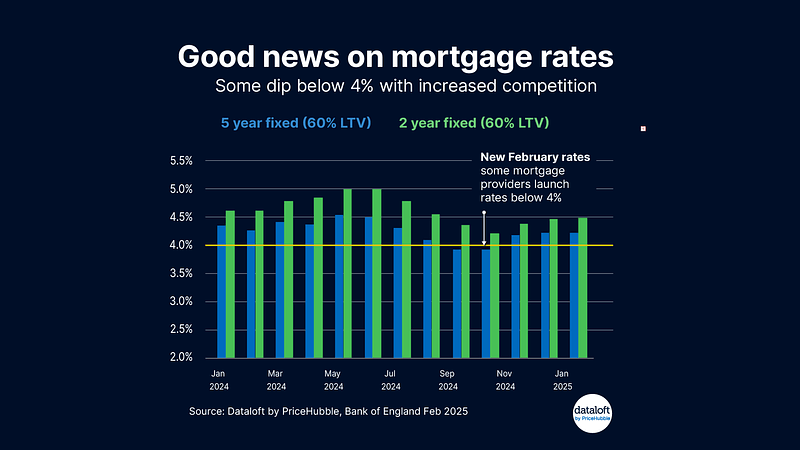

The average monthly rent in England and Wales currently stands at £1,250, whereas the typical mortgage repayment for first-time buyers is £1,066. This comparison is based on a first-time buyer purchasing a £240,000 home with a 20% deposit, a 25-year mortgage term, and a 5-year fixed interest rate of 4.4%.

The decline in mortgage rates has further supported this shift, with monthly mortgage payments for the average first-time buyer home having peaked in mid-2023 before decreasing by 10%.

However, despite the relative affordability of mortgage payments compared to rent, the challenge of saving for a deposit remains a significant barrier, as a 20% deposit for an average-priced first-time buyer home amounts to £48,000.

This data underscores a changing financial landscape where purchasing a home may now be a more economical option than renting, provided buyers can overcome the upfront financial hurdles.

First-time buyer monthly mortgage now 15% cheaper than renting Read More »