Is Autumn a popular time to move?

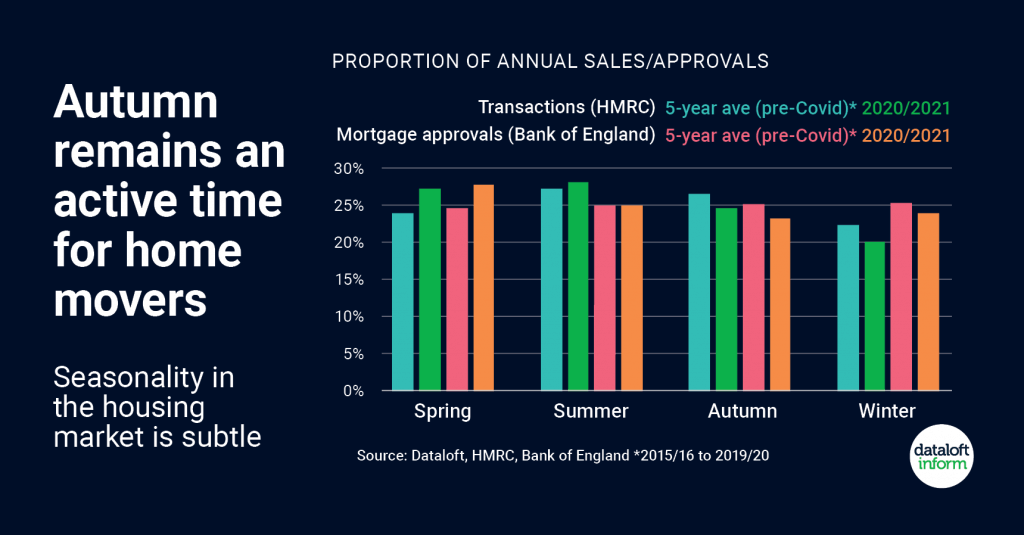

- Traditionally, the perception is that the housing market is more active spring and summer. Sales and mortgage approvals data reveals a more even spread of activity throughout the year.

- In the 5 years pre-pandemic, summer (27%) and autumn (26%) recorded the highest proportion of sale completions. The lag between exchange and completion suggests peak in market activity would have been spring / summer.

- Autumn (26%) and winter (22%) are certainly not sleepy times for the sales market. Mortgage approvals also suggest a very constant spread of demand.

- Policy changes and incentives, such as Stamp Duty changes, can artificially influence the seasonality of the sales of homes. Source: Dataloft, HMRC, Bank of England

I have always preached about September and October being key months for an Estate Agent. I personally never take annual leave in September for two reasons: 1) To be on hand to get a lot of exchanges over the line as a lot of them can be delayed due to solicitors or other parties being away for summer and 2) to agree and progress sales through with buyers; motivated to be in their new home by Christmas.

It is assuring to see the figures both pre and post covid, displaying that there is a constant spread of demand throughout the year as this will assure both buyers and sellers that there is not a right time to buy or sell, it is simply down to when someone is ready to start their property journey.

September has started very well for us here at Truuli and we feel the market is moving at a faster pace than usual, which is great considering we are in a period where there aren’t any incentives or policy changes in play.

For an up to date market valuation of your home, please call our office 0330 0430002 and speak to one of our experts.

Ryan Morgan – Truuli Property Expert

Is Autumn a popular time to move? Read More »