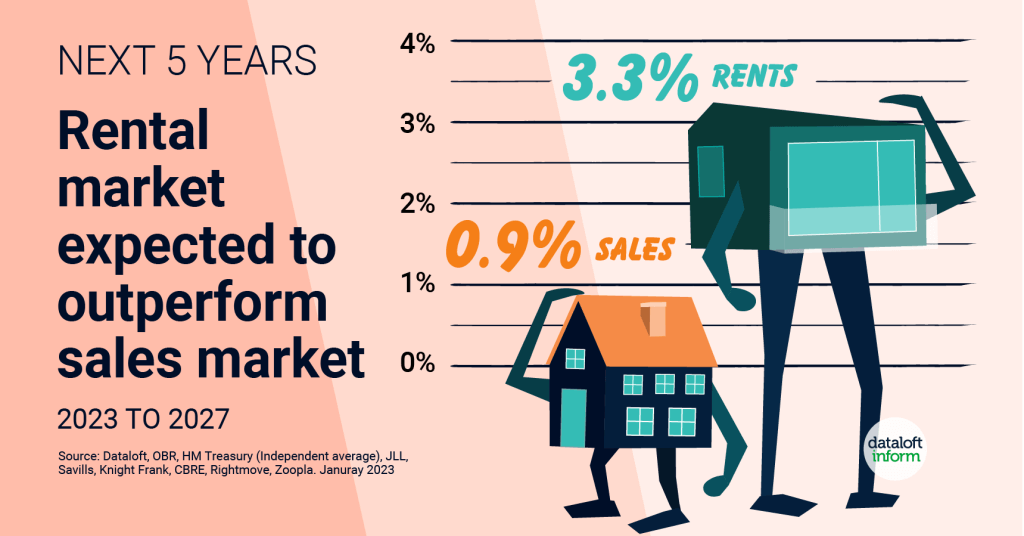

Rental market expected outperform sales market over next 5 years

- An average of economists and housing market commentator forecasts over the next 5 years expect the rental market out perform the sales market, at 3.3% compared to 0.9% per year.

- The sales market could see falls in average prices of homes by -7% by the end of 2024 but growth is then expected to return and average 3.8% per year between 2025 and 2027.

- In contrast, the rental market is anticipated to see its strongest rates of growth in 2023 and 2024 (4.4%) before stablising at 2.5% per year for the three year period 2025 to 2027.

- Housing markets that are less reliant on mortgage finance could record higher than average levels of growth. Improvements to the cost of borrowing may also result in a boost in demand in the sales market.Source: Dataloft, OBR, HM Treasury (Independent average), JLL, Savills, Knight Frank, CBRE, Rightmove, Zoopla

House prices have gone through the roof in recent years, but they are now falling amid soaring inflation and rising interest rates. Whilst landlords are raising rents to try and counter increased mortgages, they are still managing to find tenants capable of paying these higher rents. Ultimately, with the cost of living crisis, many people just can’t afford to get onto the property ladder to own their own homes.

Buying V Renting

Whether to buy or rent a home to live in is hard to decide. There are members of the public who prefer to rent as it can provide a chance for the individual to reside in a house in a premium area which would otherwise cost a lump sum if bought. A purchase can take on average 3 months whereas renting allows a prospective tenant to be in their new home within a couple of weeks. When you own a home, any repairs or maintenance are down to you and could be costly. When renting, in most circumstances, the repairs and maintenance do not cost the tenant.

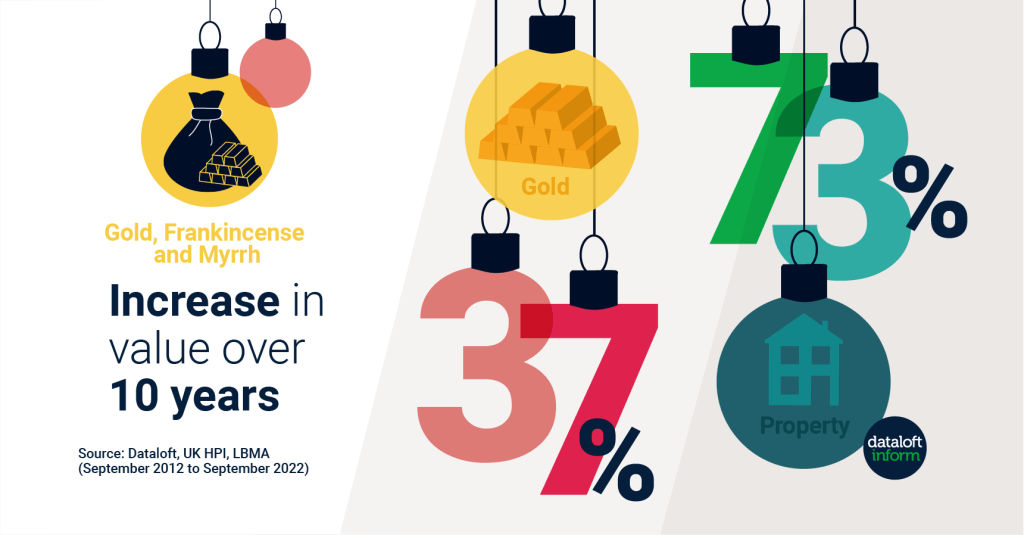

One of the main reasons to buy a home is that it is a long-term investment. With every monthly payment, you are one step closer to paying off your loan, rather than simply paying your landlord. Another significant benefit of buying your own home is that you don’t have to worry about the risk of your landlord suddenly asking to end the tenancy. Buying your home offers more security than renting, which can help you to feel more comfortable. Having the thought in the back of your mind that you might have to move home at any time can make it hard to get attached to a property.

Rental market forecast:

Looking at the above figures, for the next few years you will see the rental market thriving with its increase of 4.4% in the next couple of years then stabilising to 2.5% With prospective buyers still struggling to save deposits, if demand for rental property remains high and prices keep rising in 2023 the opportunity for landlords to generate higher rental yields will continue to increase.

Whether you are renting or you are thinking of buying, there is an ideal property for everybody. You will have to look at it on your own personal merit and circumstance. If you want and can afford to own your home, bricks and mortar still remains a great long-term investment and in most instances, mortgage payments can often be cheaper than paying rent.

Leigh Thomas – Truuli Property Expert

Rental market expected outperform sales market over next 5 years Read More »