Latest Property News From Truuli

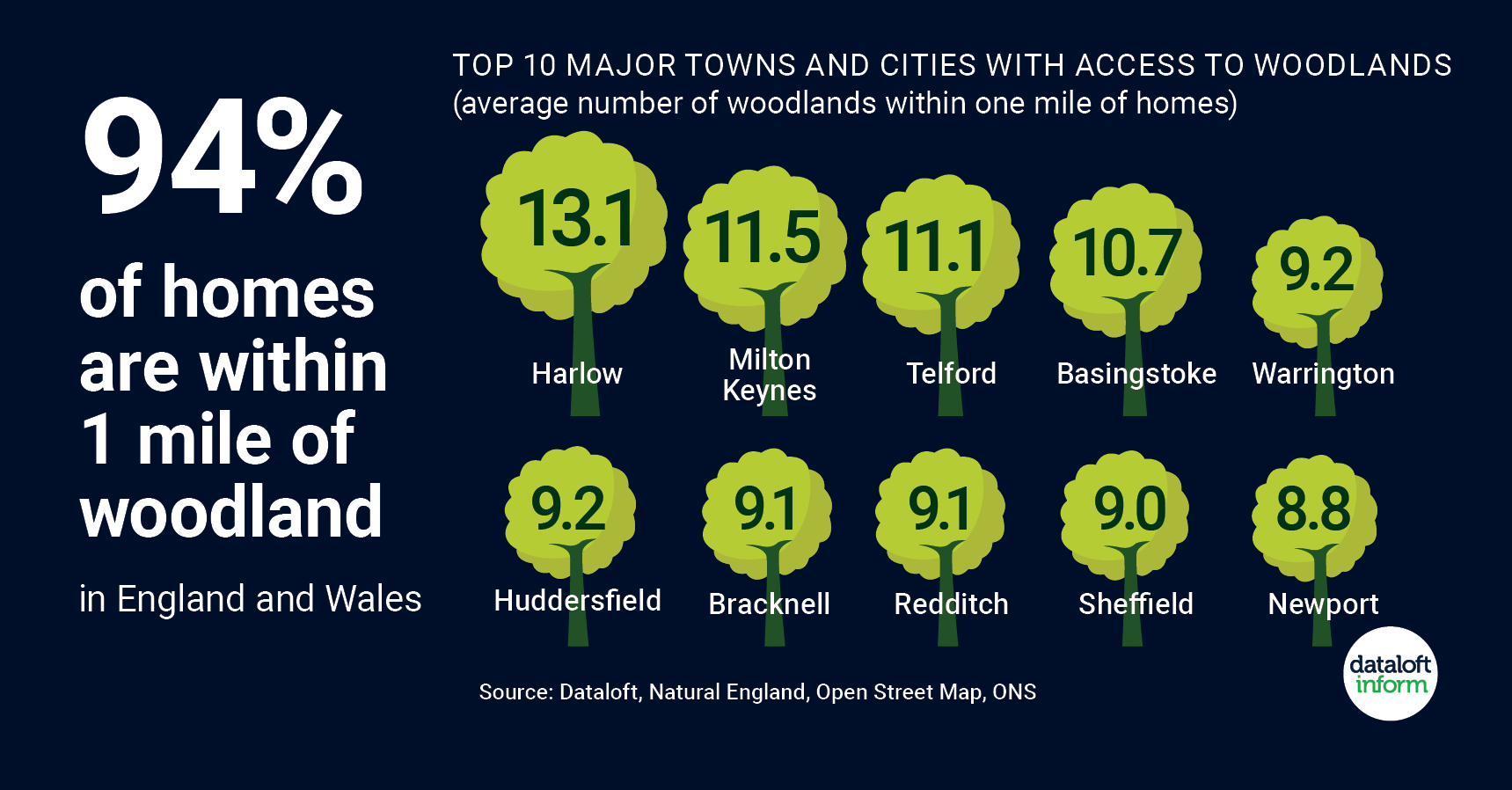

Are homes near Woodlands more popular?

94% of households within England and Wales are within one mile of an accessible woodland, despite the loss of almost half our ancient woodlands in the last 80 years. Access to woodlands isn’t just limited to the countryside. Across built-up areas there are, on average, 5.4 woodlands accessible from each household. Households in major towns and cities such as Milton Keynes and Harlow enjoy excellent access, with an average of

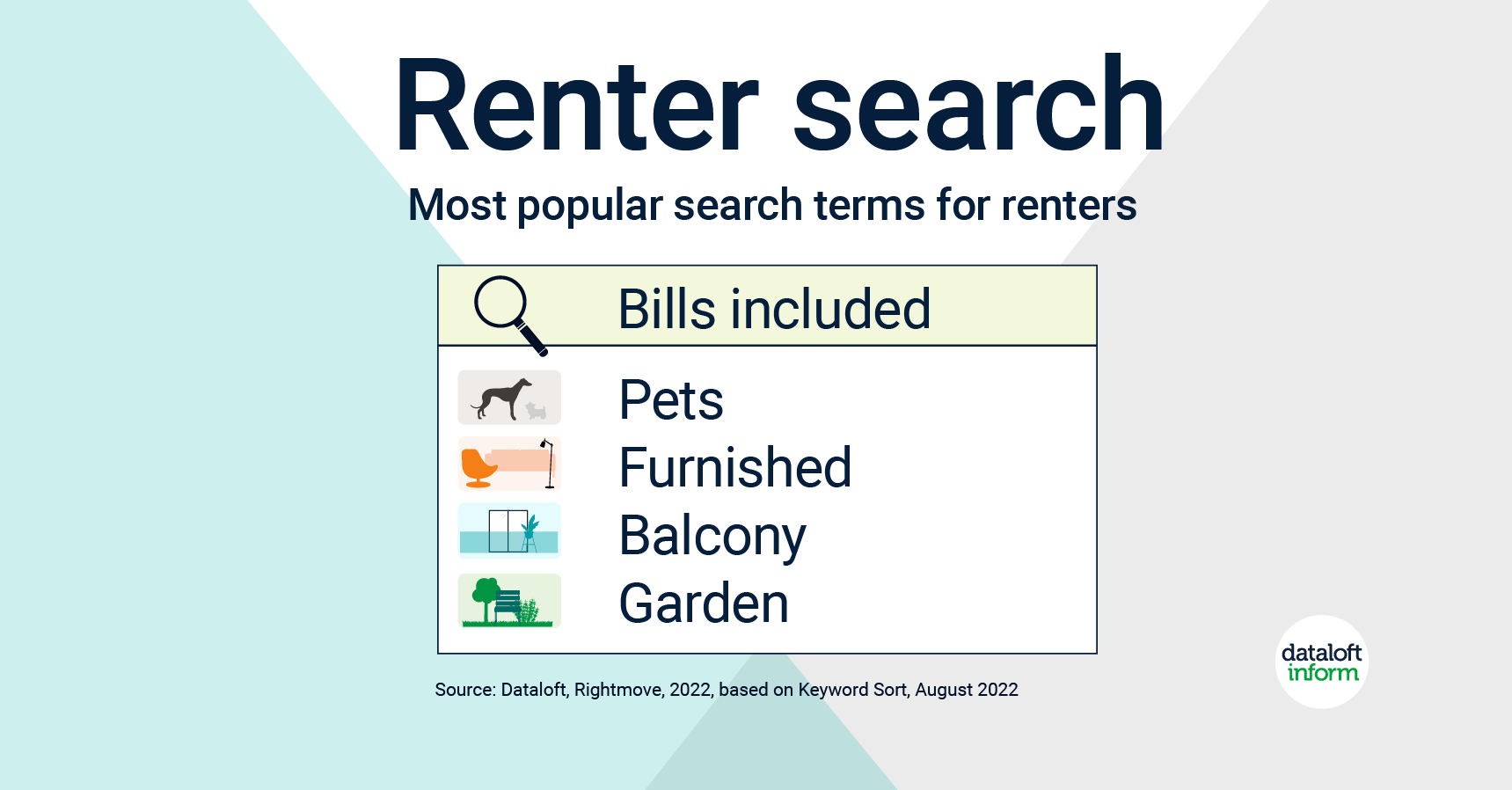

What is the most popular search criteria…

‘Bills included’ is the most popular search term for renters seeking to find a new place to call home. Renters are keen to have certainty on their monthly outgoings as the cost-of-living squeeze continues. While in 6th position in 2021, ‘bills included’ has now overtaken those prioritising pet-friendly properties or those looking for outside space, either a balcony or garden. A survey of over 12,000 renters by HomeLet and Dataloft

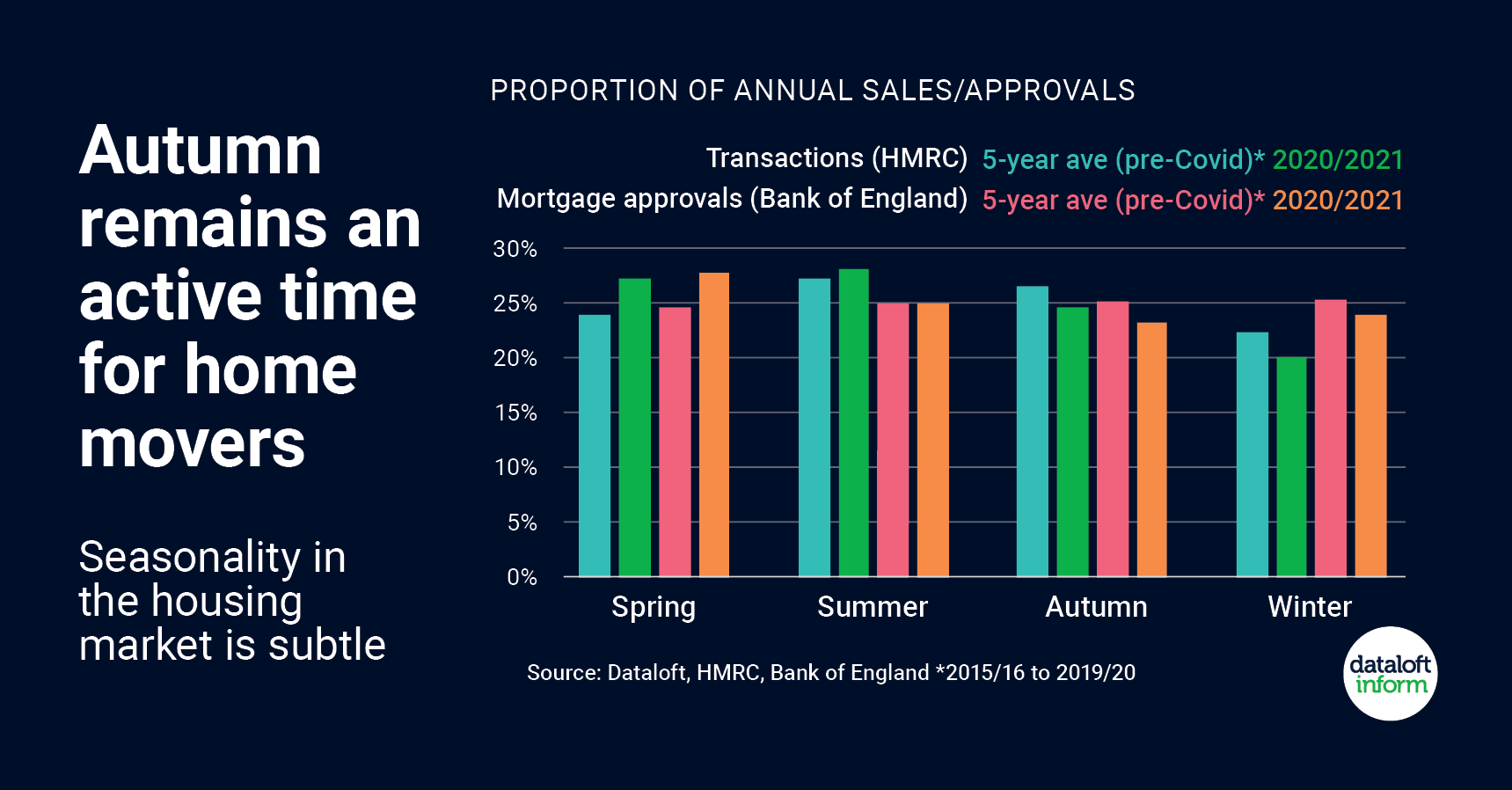

Is Autumn a popular time to move?

Traditionally, the perception is that the housing market is more active spring and summer. Sales and mortgage approvals data reveals a more even spread of activity throughout the year. In the 5 years pre-pandemic, summer (27%) and autumn (26%) recorded the highest proportion of sale completions. The lag between exchange and completion suggests peak in market activity would have been spring / summer. Autumn (26%) and winter (22%) are certainly

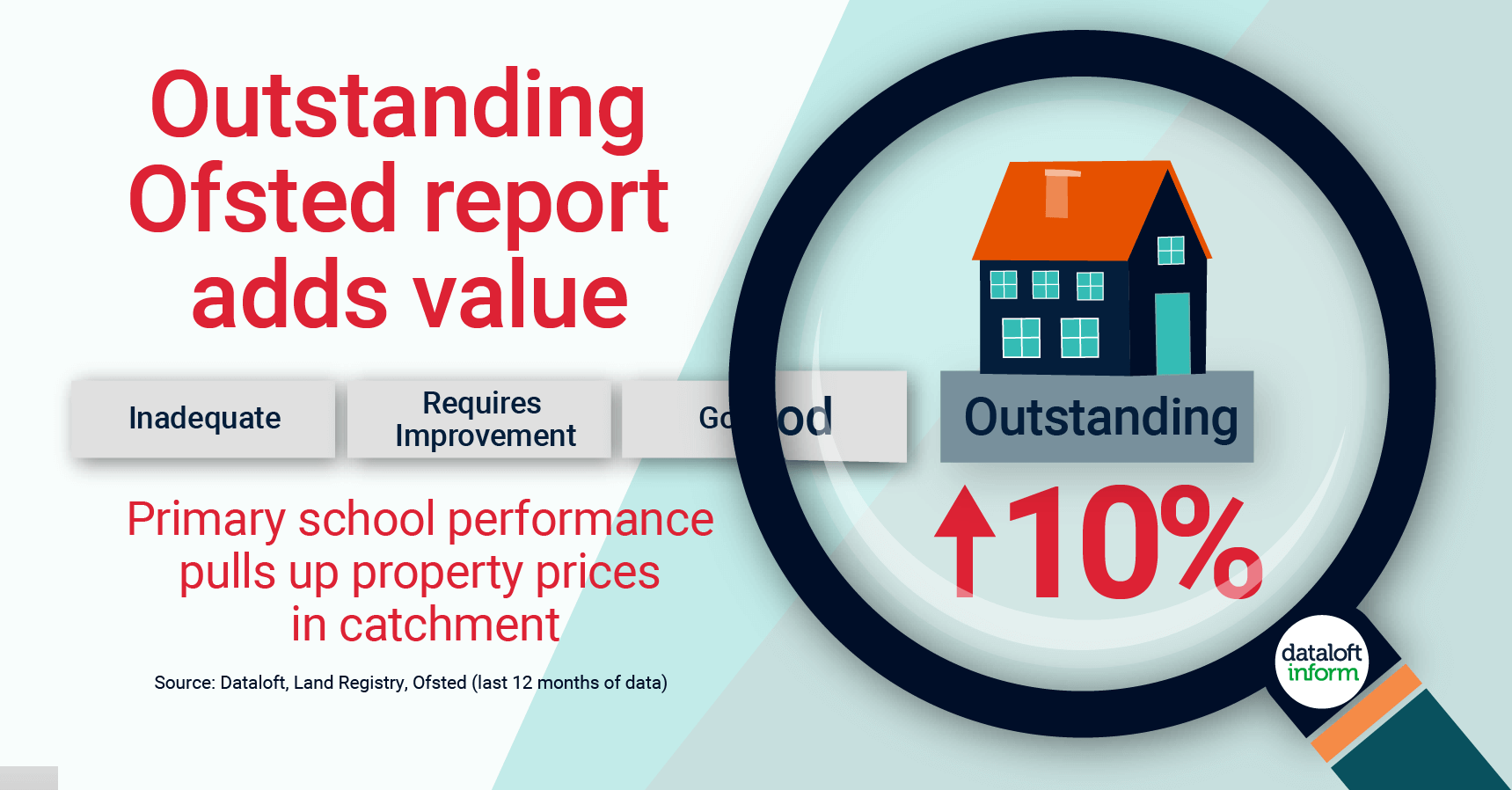

Does a good Ofsted report affect property prices?

House prices are significantly higher in the catchments of Ofsted ‘outstanding’ primary schools, even compared to those ranked ‘Good’ in their Ofsted report. Average sale prices are 10% higher around a primary school with outstanding status, (based on £ per sq ft and compared with good status), while average rents are 5% higher. There’s a similar price difference of 8% between ‘Good’ and ‘Requires improvement’ – the next Ofsted category

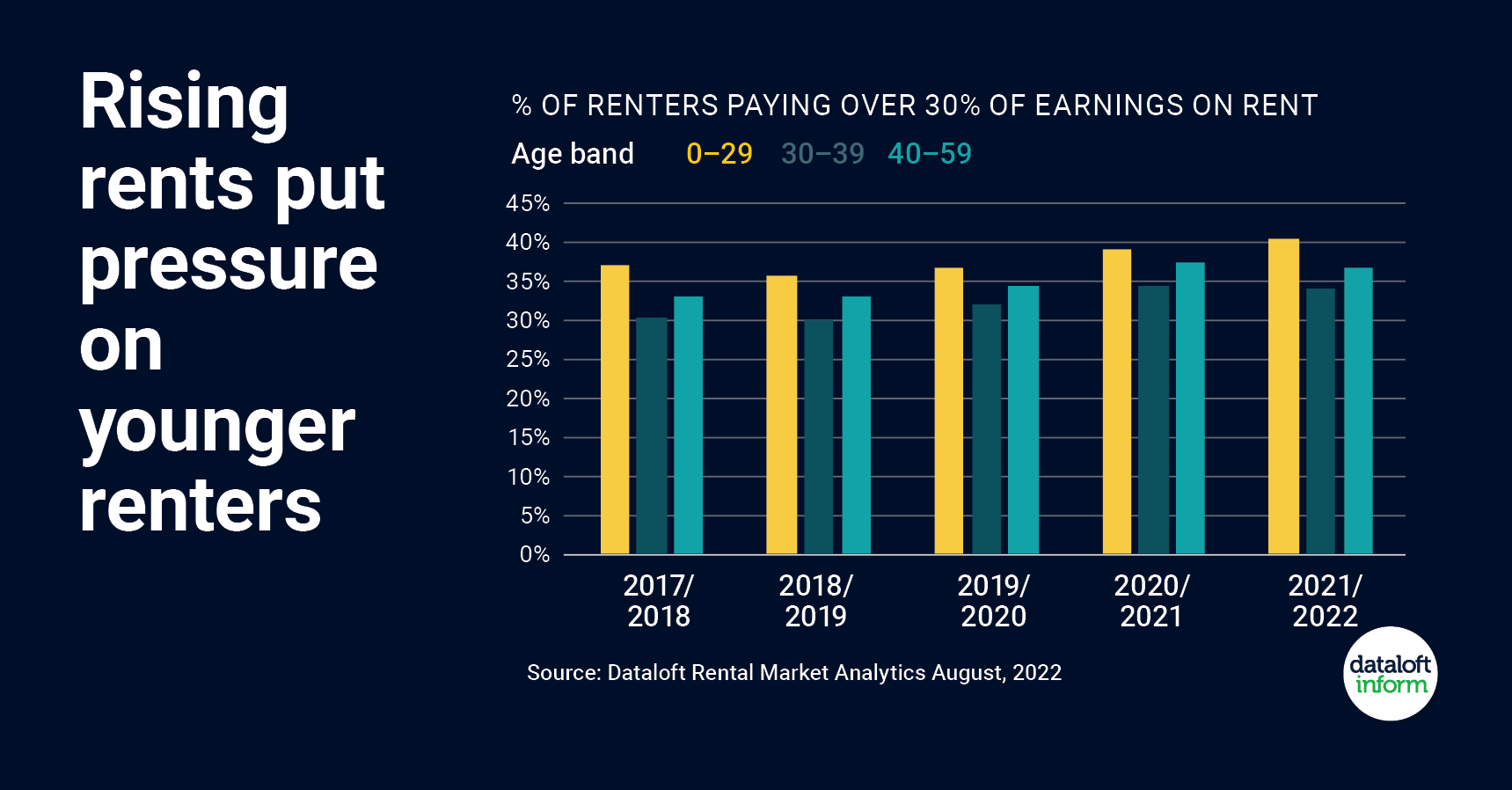

Are rising rents putting pressure on younger renters?

With the rising cost of living dominating the headlines, we have turned our attention to the rental market and the affordability pressures facing renters. Using gross incomes of renters and achieved rents we can see how much renters are really spending on rent. As featured in a recent BBC report, 4 in 10 young renters (aged under 30) are now spending at least 30% of their income on rent, the

Is the hybrid working model the way forward?

Our homes are still our offices. UK workers are going into the office an average of 1.5 days a week. Hybrid working is here to stay. More than 80% of workers said their firms had adopted the hybrid model according to a survey for The Chartered Management Institute (CMI). 53% of renters indicated that they would choose a rental property quicker if it was furnished to enable comfortable home working

Categories

- Area Guides (6)

- Buying (5)

- Buying Guide (5)

- Jobs (1)

- New Homes (1)

- News (58)