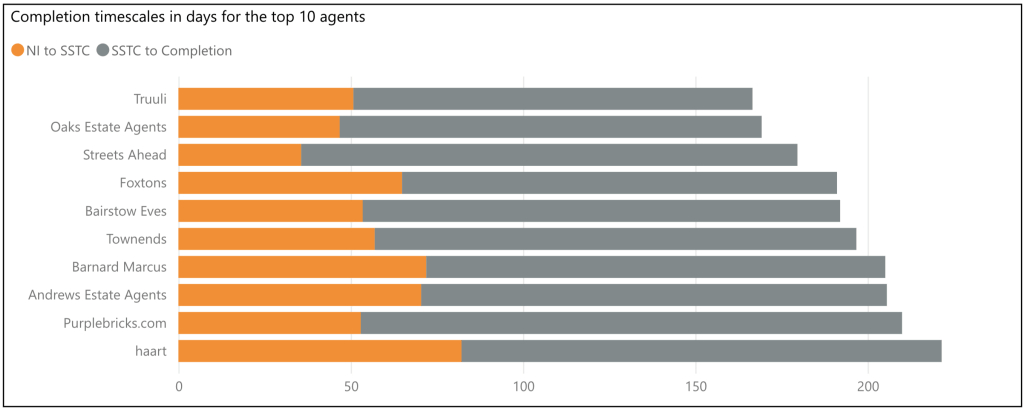

Truuli offer the quickest property sale to completion timescales

At Truuli, we pride ourselves on offering the quickest sale to completion timescales in the industry. According to the latest data compiled by Twenty EA*, we consistently outperform all other top 10 agents in this regard.

We understand that receiving an offer on your property can be an exciting experience for sellers. However, we also know that the period between offer and completion can feel like an eternity as there are several tasks that need to be performed, including searches, mortgage approvals, and enquiries.

Unlike many other estate agents who believe their job is done when they receive an offer, we at Truuli believe that our job is just beginning. We’ve found that after receiving an offer, there’s still a 40% chance that the transaction won’t go through. For this reason, our senior staff manages each sale from the time of offer all the way through to successful completion.

This period between offer and completion is what we call the ‘sales progression process’. It involves collaborating with solicitors, surveyors, mortgage companies, buyers and sellers. While much of this work happens behind the scenes, it requires a considerable degree of coordination to ensure that everything runs smoothly. At Truuli, we take great pride in providing excellent service throughout this process so that our clients can rest easy knowing that we’re working tirelessly to get them moved within their desired timescale.

Whether you’re considering selling your property or simply seeking the latest local market updates, your Truuli property expert is here to provide complimentary and transparent advice, empowering you to make informed decisions. Let us help you evaluate your options today. Click here to book a market appraisal for your property.

Truuli offer the quickest property sale to completion timescales Read More »